How Education Trends Are Shaping the Next Generation of Canadian/US Homebuyers

The dream of homeownership has long been a cornerstone of the North American experience. For generations, it represented stability, success, and a tangible asset for the future. Yet, for millennials and Gen Z in both Canada and the United States, this dream often feels distant, clouded by escalating housing costs, a competitive market, and a significant, often overlooked, factor: evolving education trends. The path from high school to a stable career, and eventually to buying a home, is no longer a straight line; it’s a complex journey heavily influenced by the choices made in the classroom and beyond.

Today’s young adults are navigating a landscape where advanced degrees are increasingly necessary for competitive salaries, but often come with a heavy burden of student loan debt. This creates a fascinating push-pull dynamic. On one hand, higher education often leads to higher earning potential, which is crucial for mortgage qualification. On the other, the repayment of student loans can delay saving for a down payment by years, sometimes even a decade. This isn’t just a personal challenge; it’s a macroeconomic shift impacting housing markets from Vancouver to Miami. Many are seeking comprehensive academic support to navigate these demanding educational paths successfully, recognizing that strong academic performance is a gateway to better career opportunities and, eventually, a home. For those pursuing rigorous programs, having expert help with financial coursework from services like MyAssignmentHelp can be the key to excelling without sacrificing precious time needed for career development or even personal finance planning.

The Debt Divide: Student Loans vs. Down Payments

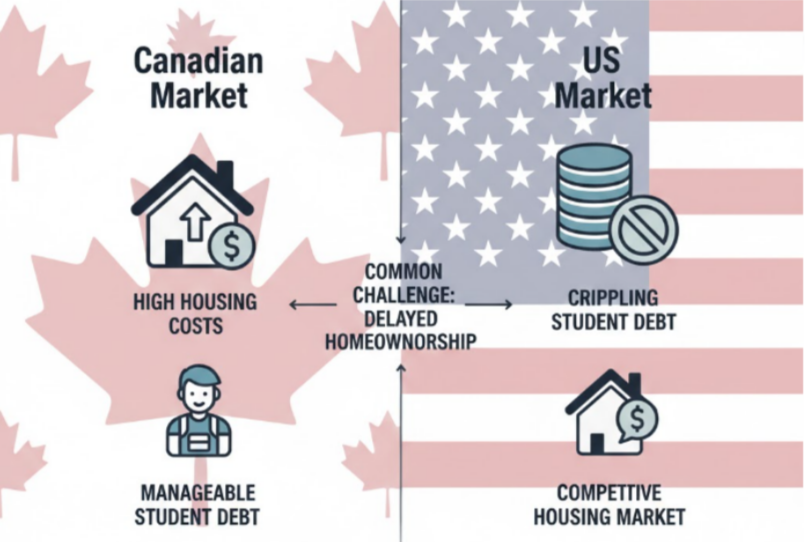

One of the most significant shifts impacting future homebuyers is the sheer volume of student loan debt. In the US, federal student loan debt alone has surpassed $1.7 trillion, while in Canada, student debt continues to be a substantial financial burden. This isn’t just about the dollar amount; it’s about the monthly payments that eat into disposable income. Lenders assess a borrower’s debt-to-income (DTI) ratio, and high student loan payments can severely limit how much a bank is willing to lend for a mortgage. This directly forces prospective buyers to delay their purchasing timeline, save less aggressively, or settle for less expensive homes further from urban centers. It’s a stark reality where the investment in education, while often beneficial long-term, creates a substantial short-term hurdle to homeownership.

Compounding this is the rising cost of living. Even those with well-paying jobs find it challenging to save the substantial down payments required, especially in red-hot real estate markets. The traditional advice of saving 20% for a down payment becomes almost insurmountable when student loan payments, rent, and daily expenses consume the majority of a paycheck. This economic pressure is leading to a growing trend of young adults living with parents longer, delaying marriage, and reconsidering traditional urban living in favor of more affordable rural or suburban areas.

The Rise of Specialized Skills and Their Market Value

Beyond the debt, the type of education also plays a critical role. The demand for specialized skills in fields like technology, healthcare, and engineering continues to outpace supply. Graduates with these in-demand qualifications often command higher starting salaries, putting them in a much stronger position to save for a home. This has created a bifurcated market: those with degrees in high-growth sectors may find their path to homeownership easier, while those with degrees in less lucrative fields face steeper challenges.

This trend underscores the importance of strategic educational choices. Young Canadians and Americans are increasingly looking at the return on investment (ROI) for their degrees, favoring programs that lead directly to high-paying jobs. Vocational training and skilled trades are also experiencing a resurgence, offering viable, often debt-free, paths to stable employment and homeownership. These practical skills, from plumbing to software development, often come with less upfront educational cost and immediate earning potential, allowing individuals to enter the housing market sooner.

For those pursuing demanding fields like finance, the complexity of coursework can be a major stressor. Navigating advanced topics like derivatives, risk management, and econometric modeling requires not just dedication, but often strategic support from an academic support platform for Canadian students that understands the rigor of these programs. It’s no wonder that many students are seeking expert help with financial coursework to ensure they master these critical concepts, positioning themselves for careers that can afford them the luxury of homeownership sooner rather than later. This kind of specialized assistance can make all the difference in achieving academic excellence and, subsequently, a lucrative career path.

Geographic Impact: Where Education Meets Opportunity

Education trends also shape where the next generation of homebuyers can realistically afford to live. Cities with strong job markets in sectors that value higher education (e.g., tech hubs, medical research centers) naturally attract graduates. However, these same cities often have the highest housing costs, creating a paradox. Graduates with the best job prospects might find themselves priced out of the very areas offering those opportunities.

This leads to a migration pattern: young professionals are increasingly looking to secondary and tertiary cities where the cost of living is lower, but opportunities still exist. For example, a data scientist might find a similar quality of life and a much more affordable home in a city like Calgary or Raleigh compared to Toronto or San Francisco. Education, therefore, doesn’t just influence if someone can buy a home, but where they can buy it, leading to a redistribution of talent and economic growth across regions. This also highlights the growing importance of local economic development, as cities compete to attract and retain skilled graduates by offering both jobs and attainable housing.

The Role of Financial Literacy and Planning

Amidst these complex trends, financial literacy plays a more crucial role than ever before. Understanding budgeting, saving, credit scores, and mortgage fundamentals is paramount for prospective homebuyers. Many educational institutions are now integrating personal finance courses into their curricula, recognizing that academic success alone doesn’t guarantee financial stability.

Beyond the classroom, digital tools and resources are making financial planning more accessible. From budgeting apps to online mortgage calculators, the next generation has unprecedented access to information that can empower them to make informed decisions. The challenge, however, is cutting through the noise and genuinely engaging with this information to create actionable financial plans. This self-driven education in personal finance is becoming as important as formal academic qualifications in the journey toward homeownership.

A New Vision for Homeownership

The confluence of student debt, specialized skill demands, and geographic shifts is forging a new vision for homeownership. It’s no longer just about buying a single-family home in the suburbs by your late twenties. The next generation is embracing diverse pathways:

- Delayed Homeownership: Accepting that saving for a down payment will take longer.

- Alternative Housing: Exploring condos, townhouses, co-ops, or even multi-generational living arrangements.

- Geographic Flexibility: Being open to relocating to more affordable markets.

- Strategic Education: Investing in degrees and skills with clear economic returns.

- Financial Savvy: Prioritizing financial literacy and aggressive saving strategies.

The housing market will continue to evolve, and with it, the profile of the homebuyer. Educational trends are not just shaping individual destinies; they are reshaping entire communities and economies. By understanding these dynamics, both aspiring homeowners and those in the real estate industry can better prepare for the future. The path to homeownership for the next generation is challenging, but armed with strategic education and financial foresight, the dream remains very much alive, albeit in new and often unexpected forms.

Frequently Asked Questions

1. Can I buy a home with student debt?

Yes. While student loans affect your debt-to-income (DTI) ratio, they aren’t a dealbreaker. Lenders focus on your monthly payment and credit score. Consistently paying your loans on time can actually help your mortgage application.

2. How does education affect home value?

Properties near high-performing schools often see 10-20% higher appreciation. Homebuyers view quality education as a long-term investment, keeping demand high and house prices stable even during market downturns.

3. Why is an MBA popular for real estate investors?

An MBA is popular among real estate investors because it builds the business, financial, and strategic skills needed to evaluate deals, manage risk, and scale investments effectively. Real estate today is less about intuition and more about data-driven decision-making, and an MBA directly supports that shift.

4. How can I balance a degree and home saving?

Focus on high-ROI skills and leverage academic assistance to enter the workforce faster. The sooner you graduate with a competitive salary, the quicker you can clear debt and qualify for a home loan.

About the Author

Harrison Walker is a Financial Analyst and Real Estate Consultant focused on North American market trends. He partners with MyAssignmentHelp to provide students with the expert academic support necessary to achieve the career success and financial stability required for modern homeownership.